If you had invested ₹ on via

and stayed invested till it would have become ₹0 i.e. CAGR of 0.00%

Lumpsum DIRECT 15122023...

Read MoreAbout Kotak Corporate Bond Fund

- The Fund seeks to generate income and capital appreciation largely through a focus on investments in corporate debt securities.

Portfolio

PORTFOLIO DATA IS UNAVAILABLE

Performance

Historical Returns (as per SEBI format) as on

| Tenors | CAGR | Current Value of ₹ 10,000 invested | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Since Inception | 5Y | 3Y | 1Y | 6 M | Since Inception | 5Y | 3Y | 1Y | 6 M | |

| Kotak Corporate Bond Fund-Dir(G) | 8.11% | 7.00% | 7.95% | 9.79% | 4.85% | 26,122.44 | 14,022.60 | 12,581.30 | 10,979.12 | 10,485.33 |

| Crisil 10-year Gilt Index | 6.67% | 5.32% | 9.26% | 11.77% | 6.04% | 22,163.80 | 12,960.65 | 13,044.58 | 11,176.80 | 10,603.89 |

| NIFTY Corporate Bond Index A-II | 7.55% | 6.13% | 7.57% | 7.93% | 4.33% | 24,513.63 | 13,464.69 | 12,447.45 | 10,792.77 | 10,433.40 |

Lumpsum DIRECT 15122023Read More

As on May 8, 2025

Rolling Returns

| 10 Year | 7 Year | 5 Year | 3 Year | 1 Year | ||

|---|---|---|---|---|---|---|

| Average | 7.98 | 8.01 | 7.99 | 7.92 | 8.02 | |

| Maximum | 8.27 | 9.44 | 9.77 | 10.90 | 15.00 | |

| Minimum | 7.62 | 7.01 | 6.64 | 4.97 | 2.30 | |

| % times +ve returns | 100 | 100 | 100 | 100 | 100 | |

| % times returns > | 100 | 100 | 84.46 | 68.53 | 66.75 |

The returns are of Direct Growth Plan. Returns are calculated since inception with daily rolling frequency for the respective periods.

SWP Calculator

SWP Calculator

Scheme Name : Kotak Corporate Bond Fund - Direct Plan Growth

| NAV Date | NAV | Units | Cash Flow | Scheme Value |

|---|

Historical Returns (as per SEBI format) as on 30 April 2025

| Tenors | CAGR | Current Value of ₹ 10,000 invested | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Since Inception | 5Y | 3Y | 1Y | 6 M | Since Inception | 5Y | 3Y | 1Y | 6 M | |

| Kotak Corporate Bond Fund-Dir(G) | 8.11% | 7.00% | 7.95% | 9.79% | 4.85% | 26,122.44 | 14,022.60 | 12,581.30 | 10,979.12 | 10,485.33 |

| Crisil 10-year Gilt Index | 6.67% | 5.32% | 9.26% | 11.77% | 6.04% | 22,163.80 | 12,960.65 | 13,044.58 | 11,176.80 | 10,603.89 |

| NIFTY Corporate Bond Index A-II | 7.55% | 6.13% | 7.57% | 7.93% | 4.33% | 24,513.63 | 13,464.69 | 12,447.45 | 10,792.77 | 10,433.40 |

Lumpsum DIRECT 15122023

Fund

Tier 1 Benchmark

Tier 2 Benchmark

Kotak Corporate Bond Fund (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds. A relatively high interest rate risk and moderate credit risk.

This open ended fund Scheme is suitable for investors seeking - Regular Income over short term

- Income by investing in fixed income securities of varying maturities and predominantly investing in AA+ and above rated corporate bonds.

The above riskometer is based on the scheme portfolio as on 30 April 2025 . An addendum may be issued or updated on the website for new riskometer.

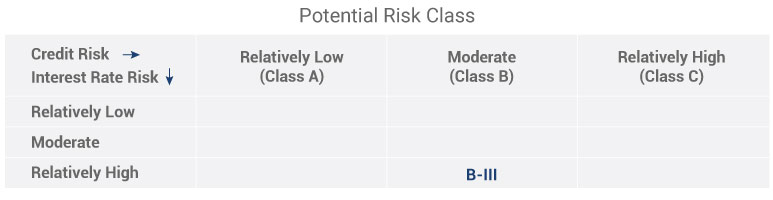

Potential Risk Class matrix consisting of parameters based on maximum interest rate risk (measured by Macaulay Duration (MD) of the scheme) and maximum credit risk (measured by Credit Risk Value (CRV) of the scheme).

Start Date of the Investment is considered as 1st of Every Month. Exit Load, Stamp Duty & STT are ignored for ease of calculation. Data Source: We have considered NAV Direct Plan Growth Option for the above scheme, Past Performance may or may not be sustained in the future. In view of the individual nature of tax consequences, each unit holder is advised to consult their tax advisors. All figures and other data given in this document are as of 30 April 2025. The same may or may not be relevant at a future date. The AMC takes no responsibility for updating any data/information in this material from time to time. The information shall not be altered in any way, transmitted to, copied, or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without the prior written consent of Kotak Mahindra Asset Management Company Limited. Kotak Mahindra Asset Management Company Limited (including its affiliates), the Mutual Fund, The Trust and any of its officers, directors, personnel, and employees shall not be liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as well as any loss of profit, in any way arising from the use of this material in any manner. Further, the information contained herein should not be construed as a forecast or promise. The recipient alone shall be fully responsible/liable for any decision taken based on this material.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Details

Fund Managers

Mr. Manu Sharma See All Funds Managed

Mr. Deepak Agrawal See All Funds Managed

Authorized Participants

- 1. Kotak Securities

- 2. Parwati Capital Market Pvt. Ltd.

- 3. Kanjalochana Finserve Pvt. Ltd.

- 4. Motilal Oswal Securities

- 5. Riddhi Siddhi

Expense Ratio (Direct) **

Expense Ratio (Regular) **

Source: *ICRA MFI Explorer ## Risk rate assumed to be % (FBIL Overnight MIBOR rate as on NA) **Total Expense Ratio includes applicable B30 fee and GST.

Source: *ICRA MFI Explorer

## Risk rate assumed to be %

(FBIL Overnight MIBOR rate as on NA)

**Total Expense Ratio includes applicable B30 fee and GST.

A) Regular Plan B) Direct PlanOptions: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

Initial Investment: Rs5000 and in multiple of Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in multiples of Rs1for purchase and for Rs0.01 for switches.

Ideal Investments Horizon: 1-1.5 year

Entry Load: Nil.

Exit Load: Nil. (applicable for all plans)

Fund

Tier 1 Benchmark

Tier 2 Benchmark

Kotak Corporate Bond Fund (An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds. A relatively high interest rate risk and moderate credit risk.

This open ended fund Scheme is suitable for investors seeking - Regular Income over short term

- Income by investing in fixed income securities of varying maturities and predominantly investing in AA+ and above rated corporate bonds.

Potential Risk Class matrix consisting of parameters based on maximum interest rate risk (measured by Macaulay Duration (MD) of the scheme) and maximum credit risk (measured by Credit Risk Value (CRV) of the scheme).